How COVID is changing the way we shop

Presented by:

Josi Mathar — 2020

The current landscape is united in one picture: the empty supermarket shelf. Covid is rapidly changing the way we shop with growth in online shopping putting unprecedented strain on supply chains. The time is now for brand leaders to take action and understand how to increase online product visibility. Understand the levers and action you can take today for your brand to capture and grow market share.

Demand for online grocery is accelerating

Looking at Google Trend data for the UK over the past seven days, key words such as online shopping and food delivery peak in light of growing public awareness to avoid outdoor spaces and larger group gatherings. Nielsen’s most recent analysis mirrors the observation: along six consumer behavior thresholds, the researchers have identified early signs of consumer spending trends for health supplies or pantry staples as well as the changing nature of purchases being made.

What’s more, these changes are observed across multiple countries and are believed to last well beyond the current crisis; even Southern Europe is discovering online shopping while living under quarantine. Signs of online shopping going mainstream was also noted by research firm Gordon Haskett: American shoppers surveyed on March 13th, one in three had bought food online compared to the previous week with 41% that had been surveyed doing so for the first time.

Stress test for the retail supply chain

Further trend analysis shows that online shopping is being adopted consistently indicating a move beyond just a first time shop. Retailers are acting fast to meet demand and invest in the infrastructure to cope with increased yet accidental stockpiling.

According to Kantar’s research, shoppers are adding only a few more items each time they shop rather than the perceived bulk buying behavior for example, only 6% of liquid soap and 3% of additional dry pasta respectively had been taken home in unusual quantities. With decreasing appetite to eat out, a large proportion of food consumption will be picked up by supermarkets both in store and online.

Consumer habits have evolved rapidly over the course of the pandemic with stay-at-home cooking offering plenty of opportunities for brands to engage shoppers on the digital shelf.

How brand strategists can increase product visibility on the digital shelf

Navigating the digital landscape brand managers and business owners alike are challenged more than ever before to make informed decisions. However, where to get the right data is often the first obstacle. With ecommerce analytics, C-suite leaders will understand their brand’s visibility online and determine the actions needed across their teams to increase the likelihood of being found on the digital shelf. Put simply, knowing how your brands perform across individual retailers websites is imperative to the success of your business in today’s buying climate.

Enable your front line staff to be effective omnichannel warriors

Fast shifts in buying behavior has seen brick and mortar shops experiencing a shock to their internal systems. The omnichannel shopper is a reality that requires staff to transfer their in shop knowledge to meet the mounting demand of online grocery shopping. Empowering your Key Account Managers to have full visibility to make effective decisions must be one of the key goals for business leaders driven to win online today. From product compliance to appearing in shoppers search results on retailer’s websites, the relevant category insights software can help you maintain commercial performance in times of volatility.

Why understanding your brand's performance online matters

Do you currently have a complete picture of how your brand is doing across the internet? How certain can you be that people looking to buy groceries online find you with their first search on Tesco, Amazon or Carrefour? As a leader you want to ensure that your sales and marketing teams reach brand consistency online collaboratively to maximise profit. Yet without a detailed overview of exactly how your products perform online, brands increase the danger of preventing sales and de-valuing brand execution especially with newbies to online shopping.

Don’t underestimate the role of the shopper’s feedback: a survey conducted by messaging platform Podium has shown that around 60% of consumers are looking at online reviews at least weekly, with a staggering 93% stating that online reviews impact their purchasing decisions. Zendesk, a customer service platform, concluded that 86% of shoppers' decisions were influenced by negative online reviews. Online grocery enables brands to foster relationships with their consumers more than ever.

Monitor reviews, react to feedback imminently to diminish any negative impact; use reviews to scale sought after items or resolve product issues flagged. Additionally, these insights can prove to be an optimization goldmine to any NPD launch you may plan now or in future. NPD can also be closely monitored with e.fundamentals’ Execute your Category Vision enabling a quick glance view of new product performance drivers.

The short term fixes you can implement today

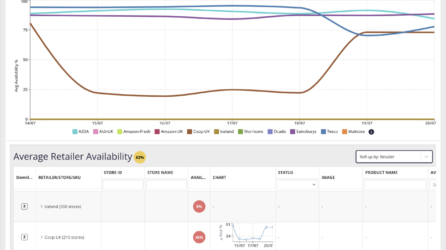

- Understand your brand’s product availability. As the demand for online grocery is surging, knowing what retailers have available will help you plan effectively to allocate stock accordingly. However, also develop contingency plans to determine how to reduce product lines if needed.

- Invest in sponsored content advisedly. Increase your brand visibility with paid for advertising through retailers choosing the right keywords. For example, boost your brand awareness if not for the first shop consumers undertake but the second where luxury, non- essential items start to enter the basket more frequently. Anticipate that with increased cooking at home, a regular pasta pesto may soon evolve into a pasta vongole.

- Assess the promotional landscape. While keeping an overview of your competitors’ product offers, stop any of your own promotions if your stock is in danger of depletion. Monitor prices across your 3P sellers to avoid overpricing - under no circumstances do you want to appear profiteering.

- Take advantage of customer reviews. Smart brands know that responding to shoppers' reviews in real time can separate the wheat from the chaff. What’s more, positive reviews can act advantageous in online search sending positive signals to both search engines and customers new and retained. Negative reviews should be escalated immediately especially with new entrants to the online shopping arena.

CPG leaders looking to win on the digital shelf long term invest in the digital shelf stack required to drive profitable actions fast and at scale.

Acting fast, not slow

Growth for online grocery shopping is currently outpacing supply across many retailers as short term changes of consumer behaviour put present systems to the test. For confident members of C-Suites, recognizing and acting on the opportunity to radically optimize their ecommerce strategy will serve brands well beyond a short term rush. While the boomlet may not last for some industries, the crisis will give a permanent upgrade to online companies with fast adoption to online grocery shopping at the forefront. C-Suites need to look to invest and understand the drivers of digital shelf performance. Equipping your sales and marketing teams with the critical insights to make impactful decisions, brand owners ensure their products cut through the noise of shoppers stocking their “pandemic pantry”.

All the digital Shelf Analytics You Need to Succeed at Speed & Scale

See why world leading brands choose e.fundamentals for actionable digital shelf insights

Request A demoLatest Resources

How local is your global ecommerce strategy?

Global ecommerce success requires smart local adaption, but it’s easier said than done. We explain how CPGs can strike the right balance between global ambitions and local market realities.

How to create an eCommerce marketing strategy that delivers for CPGs

The goal of an ecommerce marketing strategy is to be seen, heard, and bought. Here's what it takes to create one that delivers for CPGs.

How to build a stronger brand with eCommerce analytics tools, Part I

This post was updated and originally published May 2020. As a brand owner selling through online retail websites like Tesco, Amazon and Walmart you need retail insight data to help…

Product update: Better range reporting online

This post has been updated and was originally published April 2020. As a company dedicated to supporting growth driven CPG brands with actionable, easy to understand eCommerce insights and analytics,…

How to drive category growth online in 2023 w/ Mondelēz International

How to drive category leadership online Whether it’s inflation or supply chain disruption, the CPG industry has had its fair share of challenges in 2022. But throughout the economic and…

The key factors that drove digital shelf success in 2022 – and what to focus on in 2023

2022 proved a tough year for grocery retailers and suppliers, but smart CPGs still managed to achieve outstanding results on the digital shelf. This is what they got right, and how to drive eCommerce success over the coming 12 months.

View Our Most Popular resources to help you learn and win on the digital shelf.

The Ultimate Guide to Content Management on the Digital Shelf

The Digital Shelf Cast - Listen to our latest episode